Unlock the Power of Employee Benefits Through Better Communications

The recently released 2025 Workplace Benefits Report put out by Bank of America paints a mixed picture of how effectively organizations are supporting employees in achieving their personal financial goals.

The study focuses largely on financial wellness (not a surprise given the sponsor of the study) and provides a lot of data on how employee expectations match up – or don’t – with what’s on offer from employers. But from our perspective the most interesting parts of the report describe the disconnect between programs offered by employers and the knowledge of those programs as reported by employees.

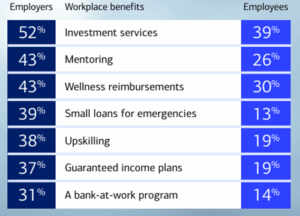

Consider, for example, the following. The column labeled “Employers” is the percentage of surveyed employers that offer a particular benefit while the “Employees” column is employees who responded that they are aware that their employer offers the benefit:

In every case, employers seem to be falling short when it comes to making employees aware of benefits that are available to them.

Another example found in the report relates to Health Savings Accounts (HSAs). An HSA, when paired with a high-deductible health plan (HDHP), allows employees to save for both current and future health care expenses. But one problem noted in the survey is that many employees who do have access to an HSA don’t fully understand how the accounts work. For example, many employees don’t realize that, in contrast to Flexible Savings Accounts (FSAs), HSA contributions roll over year to year, giving account holders a vehicle to build savings for future health care expenses.

So what can employers do to reduce the disconnect between what they offer and what employees know about what’s available?

The key is better communication. The challenge, of course, is that while it might seem like a perfectly obvious answer, the trick is in the execution. So how can employers do a better job of helping employees understand their benefits? Here are four suggestions that, in our experience, can make a difference:

- View communications as an investment, not an expense – It’s understandable that benefits professionals see their main job as crafting the strongest possible employee benefits packages for their organization. The problem, though, which is well documented through many different surveys and studies, is that even the strongest employee benefits plans will be underutilized if employees don’t know about them. Communication efforts are often seen as a burden on HR staff, an unnecessary expense, or both. But without making an investment in communications, employers risk spending money on benefits that don’t have the desired effects on employee retention, engagement and well-being.

- Communicate clearly, often, and through different channels – All of us are busy and we all receive way too many emails, text messages and even actual pieces of paper in the mail. But the fact is that benefits communications can’t be a “one and done” event. Have an annual communications plan that provides information throughout the year and through different media – electronic, print, virtual, in-person, etc. While benefits professionals are well-versed in the minutiae of employee benefit plans, most employees don’t have the time, interest or expertise to do a deep dive into their employer’s benefit offerings. HR needs to do everything possible to ensure that employees know what is available to them, how it helps them meet their personal goals, and how to maximize what they get out of their employee benefits.

- Make total rewards statements a centerpiece of your employee communications – Total rewards statements help to center an organization’s overall employee communications strategy. Well designed total rewards statements can help employers meet two important goals –

- Illustrating the full investment on the part of the employer

- Educating employees on how to get the most out of their organization’s employee benefits

- Gather feedback – Are your communications hitting the mark? Be proactive about gathering feedback from employees and make changes and improvements based on that feedback.

Organizations that prioritize total compensation communications will find not only that benefit utilization increases, but so does employee engagement and satisfaction.

Contact us today to learn how RewardsFocus can help you maximize the return on your organization’s total rewards investment.